CFO Message

By improving productivity and

enhancing the financial foundation,

we will work as one to realize

an organizational shift to

profitability-focused approach

CFO MESSAGE

Review of the Previous Medium-term Business Plan Result

Evaluation of Financial Performance (Including Market Capitalization, ROE and PBR) over the Past Three Years

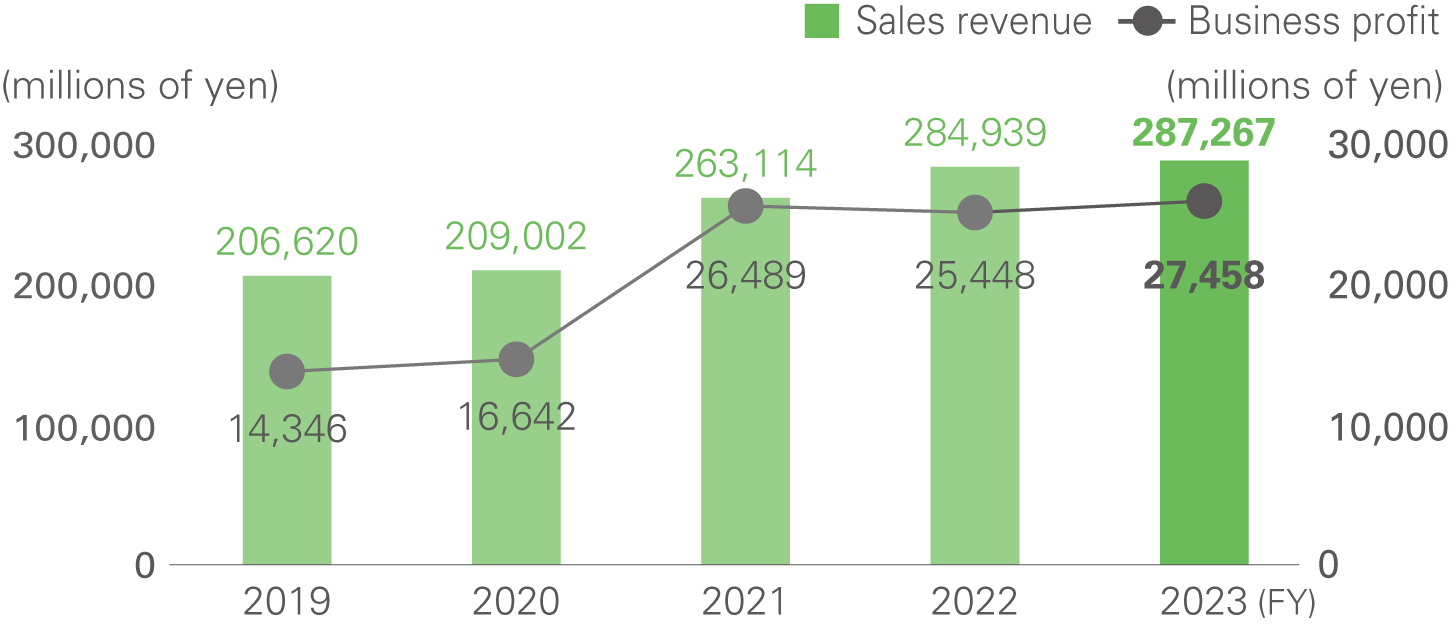

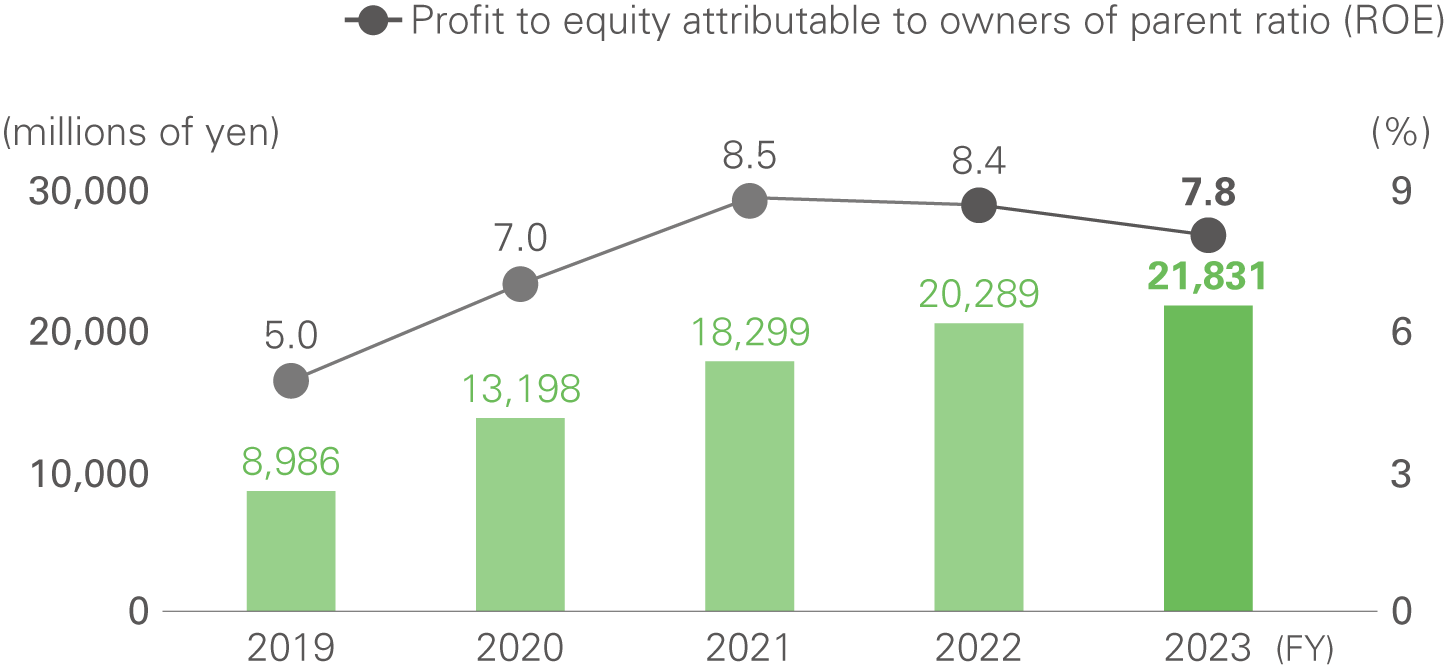

During the previous Medium-term Business Plan period starting from April 2021, we surpassed the original target earlier by achieving the sales revenue and business profit targets in the first year, after which a new set of targets was defined in April 2022. Although we were unable to achieve these new targets, the sales revenue, the business profit, and the net income during the period were the highest in our history. Our share price grew significantly during 2023, marking an approximately 90% growth* from the beginning to the end of the year, and our PBR exceeded 1.0. These demonstrate evidence, I think, that our Group’s business performance and commitments for the future have been positively evaluated in the stock market. One regret is that, however, our ROE for Fiscal 2023 reached only 7.8%. We are determined to improve this in the current medium-term period.

* Opening price at 3,905 yen on January 4, 2023 ⇓ Closing price at 7,403 yen on December 29, 2023, marking an 89.6% increase (on a pre-stock split basis)

Fiscal 2023 Results

| Fiscal 2022 | Fiscal 2023 | Increase/Decrease | |

| Sales revenue | ¥284.9 billion | ¥287.3 billion | 0.8% |

| Business profit | ¥25.4 billion | ¥27.5 billion | 7.9% |

| Operating income | ¥24.8 billion | ¥27.2 billion | 9.6% |

| Profit attributable to owners of parent |

¥20.3 billion | ¥21.8 billion | 7.6% |

| ROE | 8.4% | 7.8% | - |

Sales Revenue and Business Profit

Cash flow

ROE transition

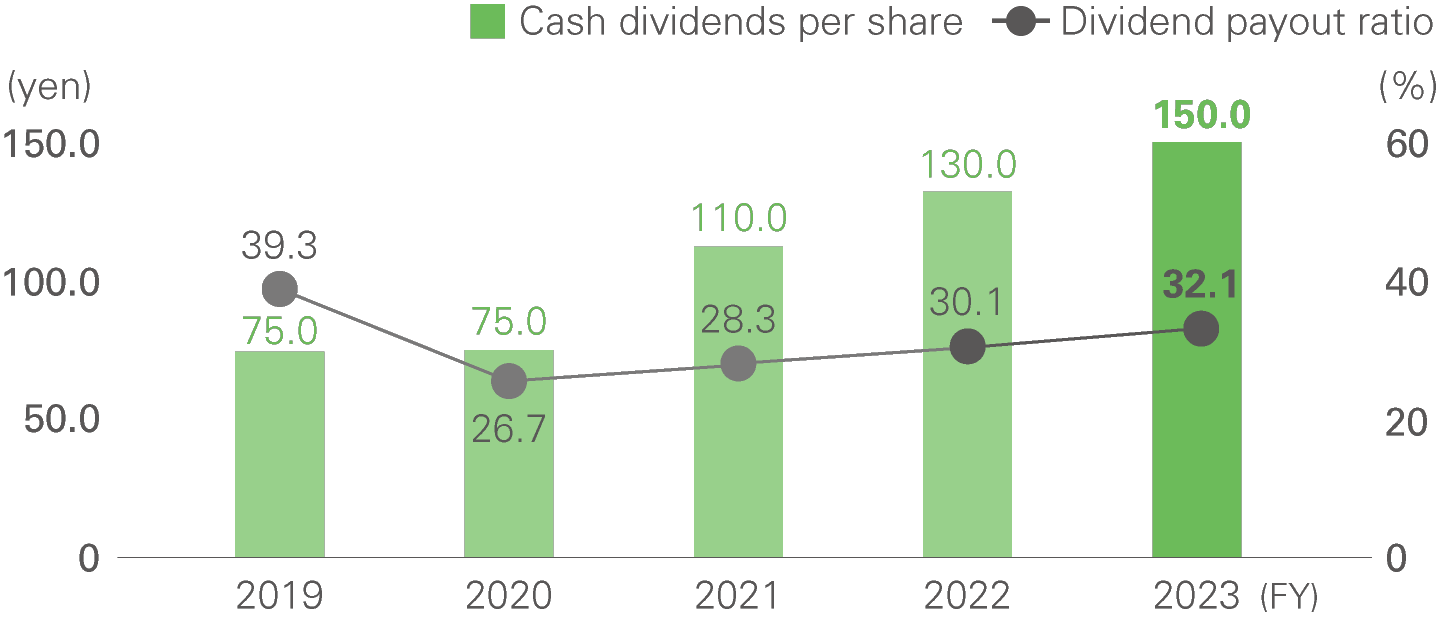

Dividends and Dividend Payout Ratio (Consolidated)

Financial Targets

A Look into Our financial Targets as a Whole

Our financial targets are planned with a focus on profitability in order to be a more powerfully profit-generating company. That is why we first set our 2030 financial targets at 55 billion yen business profit, business profit rate at 13%, and 10% ROE. By working backward from there to determine what we need to achieve, we have adopted business profits of 40 billion yen, business profit rate at 11.5% and 9% ROE as our targets for the financial year 2026. These targets have been defined through a series of in-depth discussions by and between our business segment teams to make sure that these come down to a reasonable and achievable set of targets.

Capital Efficiency Metrics (ROE and ROIC)

Our ROE target is defined with due consideration of the cost of equity. Taking the current equity situation and the future prospects into consideration, we will operate with a strong focus on profitability for the next three years so that our ROE target of 10% can be achieved by 2030.

As part of capital efficiency management, we adopt “SB-ROIC,” a unique ROIC-based metric, in FY2020 and we have been working for its improvement. As the concept of SB-ROIC and what to improve are well understood throughout the company, we will accelerate our initiative for improvement in the next three years.

Shareholder Return and Dividend Payout Ratio

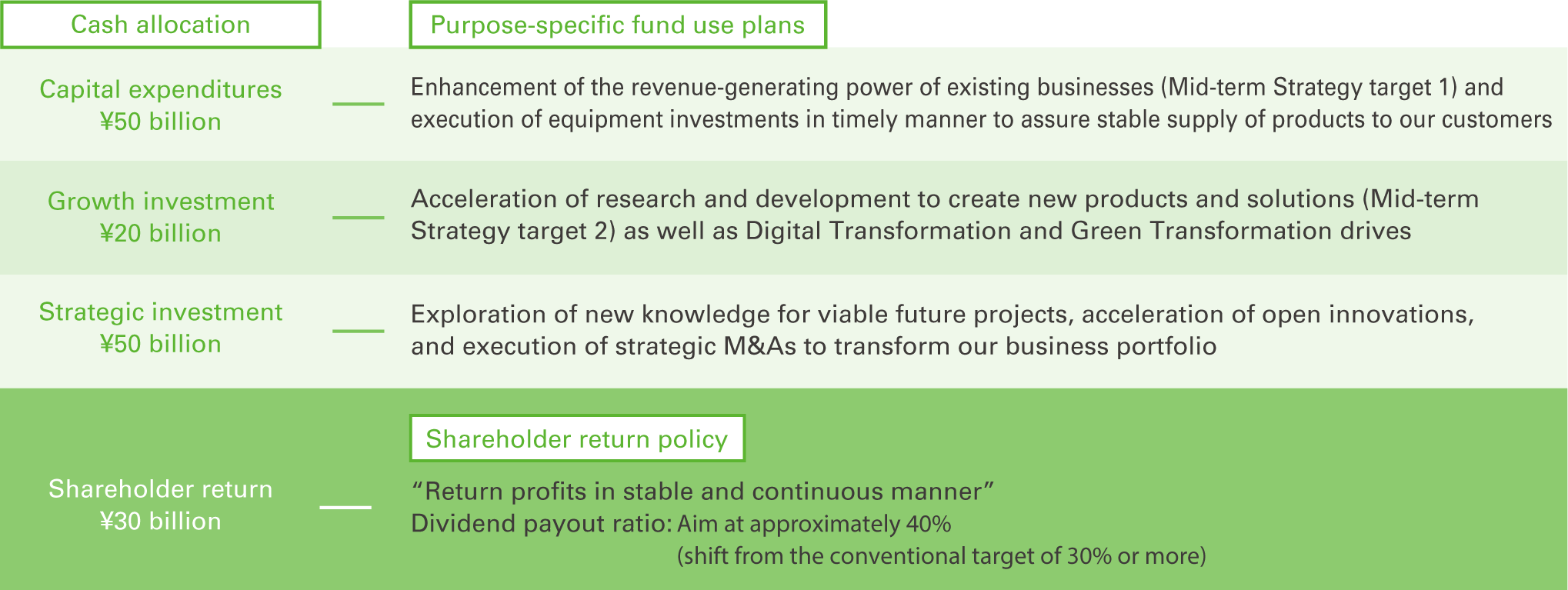

In order to achieve economic growth and a sustainable improvement in our corporate value, one of our top priorities is to build a relationship of mutual trust with our shareholders, and we will return profits to our shareholders in a stable and continuous manner. During the previous Medium-term Business Plan period, the target dividend payout ratio of “30% or higher” was successfully achieved, and we have acquired a treasury share of 3 billion yen in 2023. For the new Medium-term Business Plan period, we raised the dividend payout ratio target to 40%, for which we define a source fund of 30 billion yen in our budget. We will plan and implement treasury share acquisitions in a dynamic manner based on our business performance and cash situations at a given time.

Cash Allocation

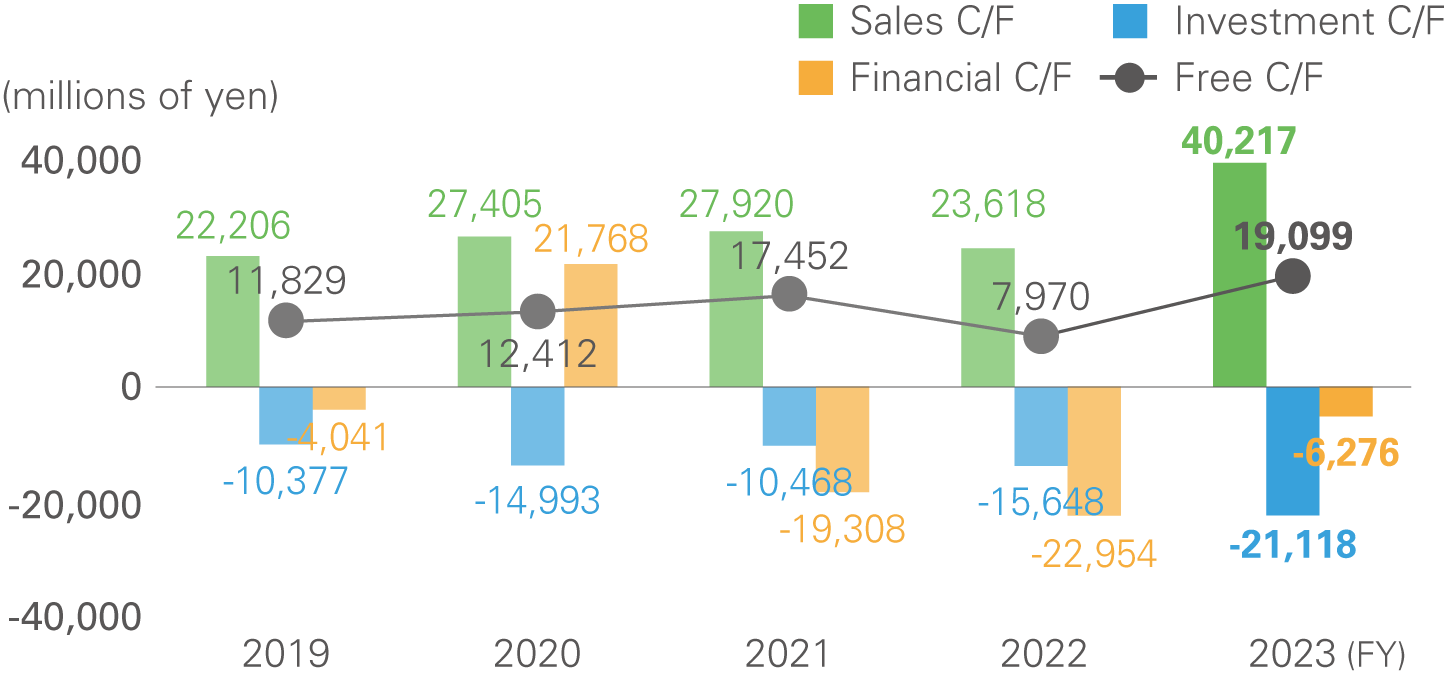

Cash Allocation Situation and Investment Policy

For the new Medium-term Business Plan period, we have clearly defined a cash allocation plan based on the business strategy and disclosed it. With a strong focus on profitability improvement, a capital expenditure of 50 billion yen is planned. Besides repairing the existing plant facilities, our top investment priorities include introduction of AI and IoT features and robotic technology to boost productivity. Specifically, we will scale up our ongoing smart factory project, which we have been working on at domestic plants and making a good progress, to a global scale, so as to aim at a world-wide basis.

Next, a growth investment of 20 billion will be allocated to research and development to create new products and solutions associated with our medium-term strategy, as well as to Digital Transformation and Green Transformation drives. As part of the Digital Transformation drive, we are considering a revamp of our corporate-wide LOB systems to realize data-driven management. For Green Transformation, which society focuses on in recent years, we will actively introduce solar power generation systems and other new technological features to accelerate our progress toward carbon neutrality.

Lastly, a strategic investment of 50 billion yen is planned. We regard this investment category primarily as a means to enable M&As to contribute to our business portfolio transformation, while the money will also be used for investment in venture capitals to explore our new future core business options.

Distribute the Operating Resources Taking the Cost of Capital into Consideration

(Fiscal 2024-2026)

Funding Plan

In addition to the combination of equity capital and the operating cash flow from the new Medium-term Business Plan period, we will also consider using external funds as appropriate based on the market environment at a given time. We will flexibly and dynamically select the optimum combination of funding means that will be the best for the Sumitomo Bakelite Group.

Dialogue with Shareholders

We will work on broadening the scope of interaction with our investors and shareholders.

For example, we are planning to publish video recordings of our financial results briefing sessions for institutional investors on the corporate website, to have more personalized interviews with institutional investor teams, organize small-scale IR meetings, and invite investors and shareholders to our IR events, all as part of the effort to improve our corporate value through open and active interactions.